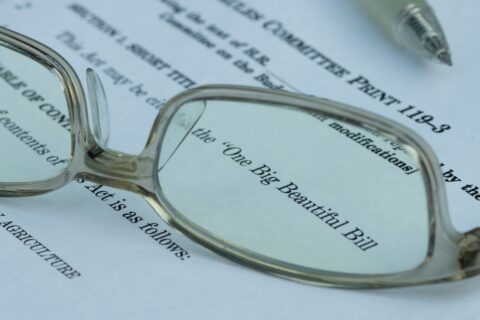

Will you be able to benefit from the One Big, Beautiful Bill Act (OBBBA), signed into law earlier this year? The law makes many tax provisions, which were scheduled to expire at year end, permanent ...

HM&M Accounting, Audit and Assurance*, & Tax Blog

What could happen if you don’t file your taxes? If you’re required to file a tax return but don’t, the IRS might step in and file one for you. That’s rarely in your favor. This ...

The One Big Beautiful Bill Act (OBBBA), which was enacted on July 4, 2025, is filled with favorable tax provisions for businesses. It makes permanent or extends many tax breaks that had already expired or ...

If you own a business or are in the process of starting one, it’s essential to maintain accurate records of your income and expenses. This not only ensures you’re capturing every tax deduction you’re entitled ...

Signed into law on July 4, 2025, the One Big Beautiful Bill is the most substantial federal tax overhaul since the 2017 Tax Cuts and Jobs Act. At over 870 pages, this sweeping legislation reshapes ...

Businesses can make many last-minute moves at the end of the year to lower their tax bills, but year-end planning can only go so far. Some of the most effective strategies take time to implement, ...

To manage their finances and accurately file their taxes, most small business owners must choose between two accounting methods: cash or accrual. This choice directly affects how and when you report income and expenses, and ...

Regularly review who’ll receive your assets. Do you know the meaning of the term “nonprobate assets?” These assets bypass more traditional estate planning vehicles, such as a will or revocable trust, and are transferred to ...

Renting to family and friends: Handle with care Ordinarily, you can deduct the expenses of owning and operating a rental property. You may even be able to claim a loss if those expenses exceed your ...

DALLAS, TX – [February 21, 2025] –HM&M, a leading accounting and advisory firm, is proud to announce that it has been named one of the Best Places to Work in Texas for 2024 by Best ...

Updated February 14, 2025 A complex trust or estate may make an election under Internal Revenue Code Section 663(b) to treat all distributions made during a 65-day period as having occurred on the last day ...

As this reminder was going to press, a Texas-based federal court issued a preliminary injunction prohibiting the federal government from enforcing the requirement to report Beneficial Ownership Information (BOI). The federal government is expected to ...