Starting tax year 2023, businesses may need to e-file certain information returns that they had historically paper filed.

The Final Regulations for filing returns and other documents electronically significantly expanded electronic filing requirements for tax returns and will require certain filers to e-file 2023 Forms beginning in 2024.

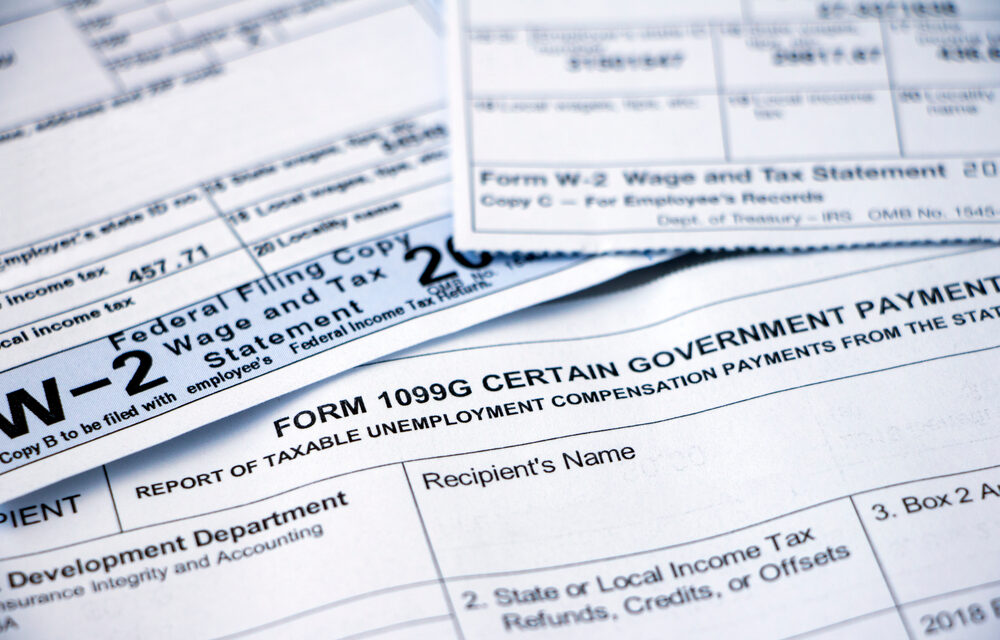

In this Blast we focus on the most common type of information returns – W-2 and 1099 series return filings. Additional information returns affected by the final regulations include Form 1042–S, Form 1094 series, Form 1095–B, Form 1095–C, Form 1097–BTC, Form 1098, Form 1098–C, Form 1098–E, Form 1098–Q, Form 1098–T, Form 1099 series, Form 3921, Form 3922, Form 5498 series, Form 8027, Form W-2, and Form W–2G.

What are the changes per the Final Regulations?

- Threshold reduced from 250 to 10: The Final Regulations reduce the 250-return threshold. It will generally require electronic filing by filers of 10 or morereturns in a calendar year.

- Non-aggregation Rule changed: It requires filers to aggregate almost all information return types covered by the regulations to determine whether a filer meets the 10-return threshold. Earlier regulations applied the 250-return threshold separately to each type of information return covered by the regulations. Note: Some employers must aggregate other entities within a controlled or affiliated service group to determine if the threshold has been crossed for a particular tax year.

- Amending Returns: Amended returns must be filed using the same method as the original return.

To facilitate these electronic filings for Form 1099 series information returns, the IRS created a new, free online portal known as the Information Returns Intake System (IRIS). It requires no special software, but does require businesses to apply in advance in order to use it.

Up to 50 W-2s can be filed online with the Social Security Administration. No special software is required, but a Business Services Account must be established in advance.

Any Penalties if a business fails to comply with the Final Regulations?

Failure to meet the new e-filing requirements may result in one or more penalties, including failure to file, failure to file in a timely manner, or failure to include correct information on a return.

Please contact your HM&M advisor if you need assistance in complying with this new electronic filing requirement.

Latest News

On June 9, the IRS released Announcement 2022-13, which modifies Notice 2022-3, by revising the optional standard mileage ...

At the tail end of 2021, the Internal Revenue Service (IRS) released new Schedules K-2 and K-3 effective ...

This information is current as of Sunday, November 21, 2021. On Friday, November 19, 2021, after the Congressional ...

HM&M Updates

DALLAS, Dec. 11, 2024 – Springline Advisory, a trailblazing financial and business advisory firm, is proud to announce its partnership ...

Last month, Senior Manager, Pearl Balsara was invited to speak at the 2023 FPA DFW Annual Conference in ...

We are pleased to announce the winners of the 2022 HM&M Excellence Awards. Ronna Beemer, Keith Phillips, and ...