Introduction to COVID-19 Impacts

COVID-19 is a new and evolving crisis, which has been labelled a pandemic by many countries and institutions, including the World Health Organization. The full impact of COVID-19 is yet to be determined, and to date has surprised most market observers how in a short period of time, it has wreaked havoc on the global economy as populations are ordered to stay home. As a result, business has ground to a halt in order to stop its spread. This has resulted in governments scrambling to provide stimulus packages hoping to revive their domestic economies.

The result of the above is that many entities across a wide variety of industries are facing extended closures, reduced access to customers, supply chain disruptions, difficulty collecting from customers and other counterparties, or other events that negatively affect operating cash flows and liquidity. The current uncertainty continues to evolve and will make it difficult for organizations to evaluate the impact on their ability to obtain, extend, or renew credit agreements, or they may experience a material adverse event, which could trigger debt to come due or other loan covenant violations. There is also uncertainty about access to other sources of capital and the ability to develop a reasonable forecast. These types of events will need to be considered in an entity’s going concern analysis.

Significant judgement will be required as no two entities fact patterns, even if operating in the same industry, will be the same, but at the end of the day it will come back to one central question, will the company have sufficient cash flows to meet their existing obligations and alleviate any conditions that raise substantial doubt about the ability to continue as a going concern. For both entities that have historically been profitable, have had ready access to liquidity, and no short-term obligations coming due, and those that are accustomed to evaluating going concern on a regular basis, the impacts of COVID-19 could create some significant challenges.

Financial Reporting Framework

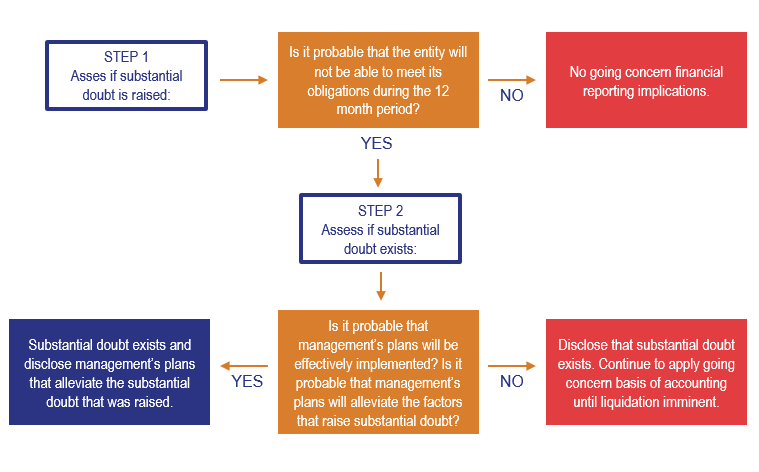

In accordance with ASC 205-40, in preparing financial statements for each annual and interim reporting period, management must evaluate whether there are conditions and events (e.g. COVID-19 crisis) that raise substantial doubt about an entity’s ability to continue as a going concern within one year after the date the financial statements are issued or available to be issued (when applicable), collectively referred to as “issued” throughout this document.

ASC 205-40 states that substantial doubt about an entity’s ability to continue as a going concern exists when in connection with preparing financial statements for each annual and interim reporting period, an entity’s management shall evaluate whether there are conditions and events, considered in the aggregate, that raise substantial doubt about an entity ’s ability to continue as a going concern within one year after the date that the financial statements are issued . T Therefore, management must evaluate whether it is likely that the entity will be unable to meet its obligations as they become due within the assessment period.

The following diagram illustrates how the two-step assessment is performed

Step 1: Determine whether conditions and events raise substantial doubt

Management’s evaluation of an entity’s ability to continue as a going concern typically is based on conditions and events that are relevant to an entity’s ability to meet its obligations as they become due within one year after the date that the financial statements are issued. The COVID-19 crisis provides new known and unknown factors for management to consider when making this evaluation.

Management’s evaluation is based only on relevant conditions and events that are known and reasonably knowable at the date that the financial statements are issued, and should be approved by those with proper authority, which for most public companies, would be their Board of Directors, or a special committee of the Board of Directors. The term “reasonably knowable” is intended to emphasize that an entity may not readily know all conditions and events, but management should make a reasonable effort to identify conditions and events that can be identified without undue cost and effort.

When evaluating an entity’s ability to meet its obligations, management should consider information about the following:

- The entity’s current financial condition, including its liquidity sources (e.g., available liquid funds, available access to credit) at the date the financial statements are issued

- The entity’s conditional and unconditional obligations due or anticipated within one year after the date that the financial statements are issued, regardless of whether they are recognized in the entity’s financial statements

- The funds necessary to maintain the entity’s operations considering its current financial condition, obligations and other expected cash flows within one year after the date that the financial statements are issued

- Other conditions and events, when considered in conjunction with the items listed above, that may adversely affect the entity’s ability to meet its obligations within one year after the financial statements are issued

Examples of adverse conditions and events that may raise substantial dout about an entity’s ability to continue as a going concern.

- Negative financial trends such as recurring operating losses, working capital deficiencies, negative cash flows from operating activities and adverse key financial ratios

- Other indications of possible financial difficulties such as defaults on loans or similar agreements, arrearages in dividends, denials of usual trade credit from suppliers, a need to restructure debt to avoid default, noncompliance with statutory capital requirements and a need to seek new sources or methods of financing or to dispose of substantial assets

- Forecasted debt covenant violations during the 12-month period even if no violation has occurredInternal matters such as work stoppages or other labor difficulties, substantial dependence on the success of a project, uneconomic long-term commitments and a need to significantly revise operations

- Internal matters such as work stoppages or other labor difficulties, substantial dependence on the success of a project, uneconomic long-term commitments and a need to significantly revise operations

- External matters such as legal proceedings, legislation or similar matters that might jeopardize the entity’s ability to operate; supply chain disruptions; loss of a key franchise, license or patent; no or reduced purchases by a principal customer, none or reduced quantities available for purchase from a supplier; and an uninsured or underinsured catastrophe such as a hurricane, tornado, earthquake or flood

Management must also consider the likelihood, magnitude and timing of the potential effects of any adverse conditions and events. This evaluation is required each reporting period.

Management’s evaluation of whether substantial doubt is raised (step 1) does not take into consideration the potential mitigating effect of management’s plans that have not been fully implemented as of the date that the financial statements are issued (step 2).

Step 2: Consider management’s plans if substantial doubt is raised

If conditions or events indicate that substantial doubt is raised, management is required to evaluate whether its plans that are intended to mitigate those conditions and events will alleviate substantial doubt.

ASC 205-40 specifies that management may consider its plans only when both of the following criteria are met:

- It is probable that those plans will be effectively implemented

- It is probable that the plans will mitigate the relevant conditions and events within one year after the financial statements are issued

Management plans that do not meet these criteria cannot be considered in the evaluation of whether substantial doubt is alleviated. These criteria prevent management from placing undue reliance on the potential mitigating effect of plans that are not probable of being implemented or succeeding. In other words, if events and conditions make it probable that the entity will be unable to meet its obligations as they become due, plans to mitigate those conditions must be likely to succeed (i.e., management’s plans must be probable of both being implemented and mitigating the events and conditions).

The evaluation of the first criterion (i.e., whether it is probable that management’s plans will be effectively implemented) is based on the feasibility of implementation of management’s plans considering an entity’s facts and circumstances and whether they make sense in light of other publicly available information (i.e. a manufacturing company plan includes mothballing a plant to preserve cash, but they have recently disclosed to investors the plant is key to achieving expected cost synergies which have not been eliminated in management’s plan).

The evaluation of the second criterion (i.e., whether it is probable that management’s plans will mitigate the events and conditions that raised substantial doubt) should consider the expected magnitude and timing of the mitigating effect. For example, if management concludes that substantial doubt is alleviated by its plan to restructure debt, management’s evaluation of the restructuring must consider whether:

- The revised debt agreement would be effective within one year of the issuance of the financial statements

- The terms of the revised agreement (e.g., debt payment schedule, interest rate) alleviate the relevant conditions and events (e.g., inability to make debt payments) with respect to both the amount and timing of payments due under the revised agreement

That is, management must be able to conclude that it is probable that the debt will be restructured and that the entity will be able to make the payments under the new debt agreement and all other obligations that are due within the year following the date the financial statements are issued

ASC 205-40 states that a plan to meet an entity’s obligations as they become due through liquidation is not considered part of management’s plans to alleviate substantial doubt, even if liquidation is probable.

The following are examples of plans that management may implement to mitigate conditions or events that raise substantial doubt, including the types of information management should consider in evaluating the feasibility of the plans:

- Plans to dispose of an asset or business:

- Restrictions on disposal of an asset or business, such as covenants that limit those transactions in loan or similar agreements, or encumbrances against the asset or business

- Marketability of the asset or business that management plans to sell

- Possible direct or indirect effects of disposal of the asset or business

- Plans to borrow money or restructure debt:

- Availability and terms of new debt financing, or availability and terms of existing debt refinancing, such as term debt, lines of credit or arrangements for factoring receivables or sales and leasebacks of assets

- Existing or committed arrangements to restructure or subordinate debt or to guarantee loans to the entity

- Possible effects on management’s borrowing plans of existing restrictions on additional borrowing or the sufficiency of available collateral

- Plans to reduce or delay expenditures:

- Feasibility of plans to reduce overhead or administrative expenditures, to postpone maintenance or research and development projects, or to lease rather than purchase assets

- Possible direct or indirect effects on the entity and its cash flows of reduced or delayed expenditures

- Plans to increase ownership equity:

- Feasibility of plans to increase ownership equity, including existing or committed arrangements to raise additional capital

- Existing or committed arrangements to reduce current dividend requirements or to accelerate cash infusions from affiliates or other investors

Historically management may have a track record of successfully planning and executing on similar plans, such as a refinancing, restructuring or asset disposal, which in a normal operating environment would support the feasibility of the plan. In the current evolving economic environment, past history may not be sufficient to support the feasibility of the plan. If part of the plan is dependent on the performance of parties outside of management’s control, such as when COVID-19 will be contained, and business returns to normal, the ability to access financing or capital markets, the ability to close on a potential asset sale, and the proceeds of such actions are subject to negotiation. As a consequence, alleviating substantial doubt may prove challenging for some companies. The preparation of multiple sensitivity analyses based on a variety of assumptions may be required to appropriately assess the probability of results in multiple market conditions. Management should also ensure that these assumptions are kept consistent with other areas of the financial statements, such as those used for estimates and impairments.

Disclosure requirements

The disclosures required by ASC 205-40 may overlap with those required by other areas within US GAAP. The FASB acknowledged this possibility but concluded that providing guidance in US GAAP about management’s responsibility to evaluate and disclose conditions and events that raise substantial doubt would improve financial reporting for all entities. As a general rule, regardless of whether substantial doubt is alleviated or not, the disclosure is very robust to help the reader understand management’s plans and the key components thereof, along with a general statement that there can be no assurance that management’s plans will be achieved.

Substantial doubt is raised and is not alleviated by management’s plans (substantial doubt exists)

If substantial doubt is raised and is not alleviated by management’s plans, an entity is required to include a statement in the notes to financial statements indicating that there is substantial doubt about the entity’s ability to continue as a going concern. The entity also is required to disclose information that enables users of the financial statements to understand all the following:

- Principal conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern

- Management’s evaluation of the significance of those conditions or events in relation to the entity’s ability to meet its obligations

- Management’s plans that are intended to mitigate the conditions or events that raise substantial doubt about the entity’s ability to continue as a going concerm

Substantial doubt was raised but was alleviated by management’s plans (substantial doubt was alleviated)

If, after management’s plans are considered, substantial doubt about an entity’s ability to continue as a going concern is alleviated, an entity is required to disclose information that enables users of the financial statements to understand all the following:

- Principal conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern (before consideration of management’s plans)

- Management’s evaluation of the significance of those conditions or events in relation to the entity’s ability to meet its obligations

- Management’s plans that alleviated substantial doubt about the entity’s ability to continue as a going concern

Ongoing disclosure requirements

An entity must include disclosures related to uncertainty about its ability to continue as a going concern in the notes to the financial statements until the conditions or events giving rise to the uncertainty are resolved. As the conditions or events giving rise to the uncertainty and management’s plans to alleviate them change over time, the disclosures should change to provide users with the most current information, including information about how the uncertainty is resolved.

Internal control over financial reporting

Management needs to evaluate whether it has adequate processes and internal controls in place to comply with the going concern evaluation requirements. Management will likely need to change its current processes and controls or implement new processes and controls to account for the impact, which could vary greatly by industry, as the COVID-19 crisis is a unique and unprecedented event. It may be necessary for management to maintain multiple 12-month rolling cash flow projections reflecting a number of different scenarios.

For example, management will need to evaluate whether it can appropriately identify conditions for its industry (e.g., critical supply shortages, ability to capture critical data remotely, cybersecurity for remote workforce, reduction in demand from significant customers, etc.) and events that raise substantial doubt. The going concern standard requires management to make a reasonable effort to identify these conditions and events. Management will need to determine whether it can do this assessment using its current processes and controls or whether it needs to modify its processes and controls or implement new ones. All significant elements of management’s evaluation of the going concern assessment, including the reviews and approval thereof, should also be subject to the entity’s control environment.

Management’s processes and controls should also address the risk that the going concern assessment could be based on incomplete or inaccurate information about conditions and events that could raise substantial doubt. In the current COVID-19 environment, the going concern evaluation could be a significant undertaking for management and given the rate of change in these factors needs to be updated frequently up to and including the date of issuance if applicable.

Key Takeaways

The ultimate impact of COVID-19 is currently unknown, but it is already having a pervasive impact on the global economy as most market commentators believe we have entered a global recession. This will put more pressure on each entity’s going concern assessment and having a robust process in place to identify and adjust to the evolving COVID-19 landscape will be critical.

Key Contact: Jorge Martinez

For more information check out HM&M’s COVID-19 Resources page.

HM&M COVID-19 ResourcesThis article originally appeared on BDO USA, LLP’s “bdo.com/insights”

Copyright © 2020 BDO USA, LLP.

All rights reserved. www.bdo.com

Latest News

On June 9, the IRS released Announcement 2022-13, which modifies Notice 2022-3, by revising the optional standard mileage ...

At the tail end of 2021, the Internal Revenue Service (IRS) released new Schedules K-2 and K-3 effective ...

This information is current as of Sunday, November 21, 2021. On Friday, November 19, 2021, after the Congressional ...

HM&M Updates

DALLAS, Dec. 11, 2024 – Springline Advisory, a trailblazing financial and business advisory firm, is proud to announce its partnership ...

Last month, Senior Manager, Pearl Balsara was invited to speak at the 2023 FPA DFW Annual Conference in ...

We are pleased to announce the winners of the 2022 HM&M Excellence Awards. Ronna Beemer, Keith Phillips, and ...