Summary

Accounting for leases between entities under common control is changing. Specifically, the new guidance includes the following provisions:

- Nonpublic entities[1] can elect a practical expedient to use the written terms and conditions of their arrangements between entities under common control (“common control arrangements”) to determine whether a lease exists and, if so, to classify and account for that lease, rather than using legally enforceable terms and conditions as currently required.

- All entities (public or nonpublic) will be required to amortize leasehold improvements associated with leases between entities under common control (“common control leases”) generally over the useful life of the leasehold improvements to the common control group, rather than over the shorter of the useful life of those leasehold improvements and the remaining lease term as currently required.

The new guidance, issued by the FASB in ASU 2023-01[2] (“Update”), is available here. Transition for the Update varies; nonpublic entities, especially those finalizing their adoption of ASC 842 should consider the effects of this Update.

Background

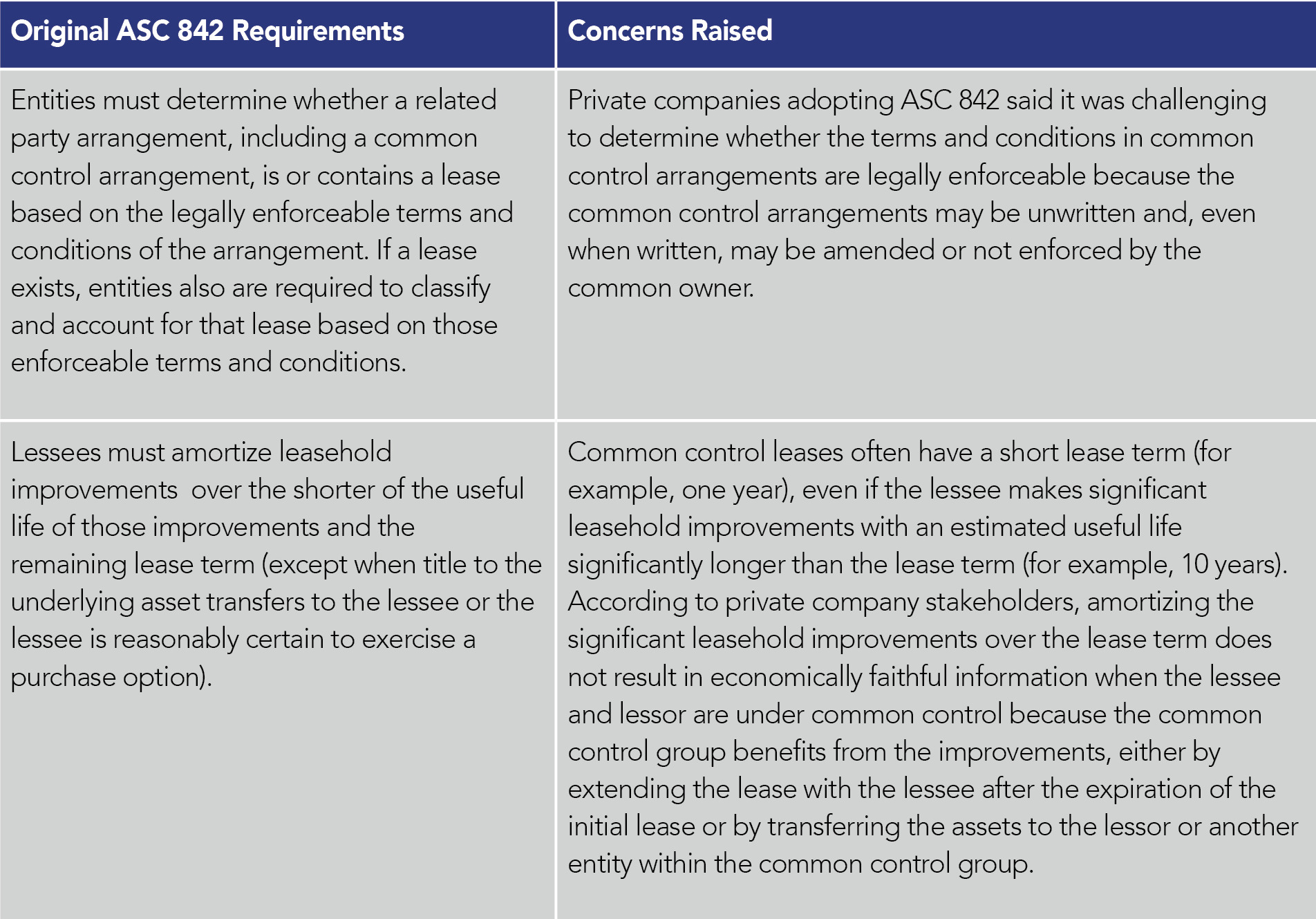

Private company stakeholders raised concerns about ASC 842 application to common control arrangements (such as arrangements between sister entities controlled by a common owner). The following table summarizes the original ASC 842 requirements and related concerns.

The Update amends the guidance in ASC 842 to address those two issues.

Insight

The FASB did not address the following issues:

- How to assess and account for related party arrangements other than common control[4] Stakeholders did not raise significant concerns about those arrangements, which are evaluated based on legally enforceable terms and conditions.

- Definition of common control. Similar to its decisions in some previous projects, the FASB noted that the term “common control” is used in other areas of U.S. GAAP. The FASB observed that an entity may refer to the SEC staff’s observations in Emerging Issues Task Force (EITF) Issue 02-5, Definition of “Common Control” in Relation to FASB Statement No. 141, acknowledging that private companies and most not-for-profit entities may apply a broader definition of common control. We believe that an entity should apply the term “common control” consistently as an accounting policy election. Also, at a minimum, we believe common control arrangements include arrangements in which a controlling financial interest exists, as defined in ASC 810, Consolidation.

- Which party to the common control lease is the owner of improvements made to a leased asset. The FASB acknowledged that various reasonable approaches exist in practice and, therefore, decided not to provide guidance in the Update.[5]

Main Provisions

Terms and Conditions to Be Considered

The Update provides nonpublic entities a practical expedient to use the written terms and conditions of a common control arrangement to determine whether a lease exists and, if so, to classify and account for that lease. Under the practical expedient, an entity assesses whether the written terms and conditions convey the practical right (rather than an enforceable right) to control the use of an identified asset for a period of time in exchange for consideration to determine whether a lease exists. If so, the entity classifies and accounts for the lease based on those written terms and conditions. The practical expedient may be applied on an arrangement-by-arrangement basis.

If no written terms and conditions exist, the entity cannot apply the practical expedient and it must use the enforceable rights and obligations to apply ASC 842 to the common control arrangement, like any arrangement between unrelated parties or related parties not under common control. However, as a part of transition, an entity may document the unwritten terms and conditions of existing common control arrangements. Such documentation must be completed before the entity’s first interim or annual financial statements in which the Update is first applied are available to be issued.

The following concepts are also important:

- Whether the entity applies the practical expedient or not, if the common control arrangement is not a lease, the entity applies other U.S. GAAP to account for both the arrangement and any improvements made by the customer to the supplier’s asset. That is, improvements are recognized on a customer/lessee’s balance sheet as leasehold improvements only when the arrangement is or contains a lease.[6]

- Applying the practical expedient does not eliminate the need for an entity to apply other relevant guidance in ASC 842 if the common control arrangement is or contains a lease. For example, an entity is still required to determine whether the arrangement contains lease and non-lease components or to evaluate the lease term if there are lessee options to extend or not terminate the lease.

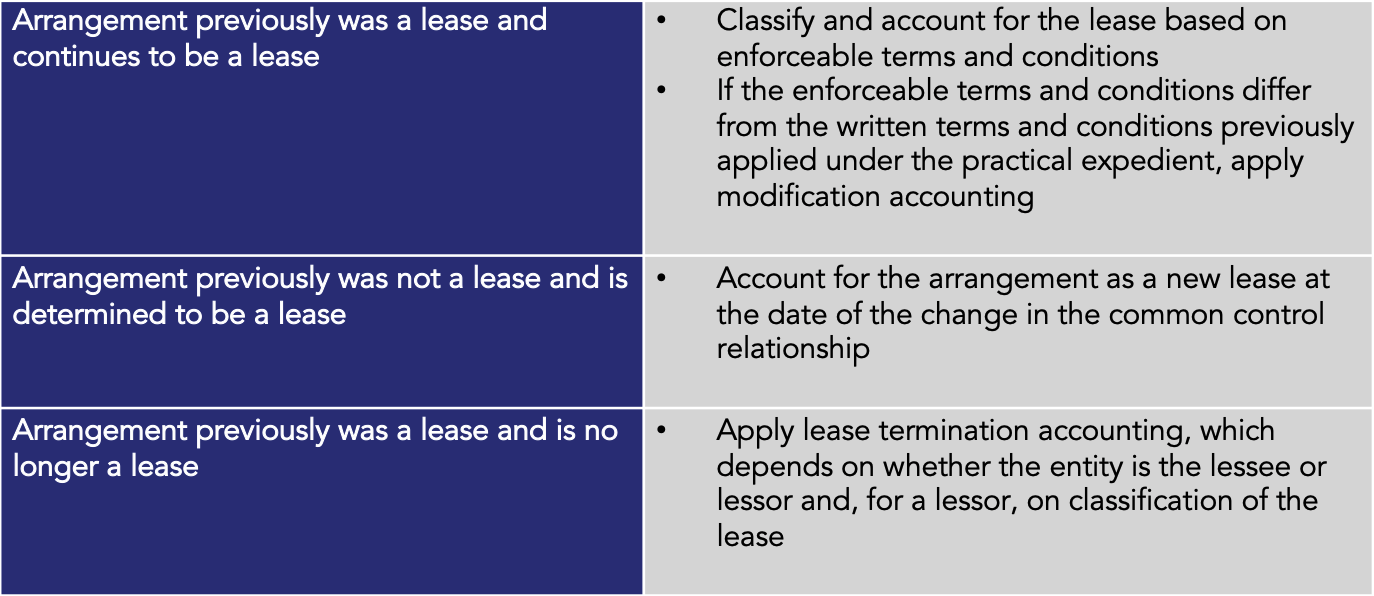

Changes to Common Control Relationships

If, after applying the practical expedient, the common control relationship changes such that an arrangement is no longer between entities under common control, an entity uses the enforceable rights and obligations to determine whether a lease exists and follows the relevant accounting approach discussed below:

Insights

When using the transition relief described above, private entities should document the terms and conditions of common control arrangements that were in effect and considered in applying ASC 840, Leases. Any revision to those terms and conditions that change the scope of the lease or the consideration for the lease should be accounted for as modifications (at the effective date of such modification), rather than considered part of the adoption of ASC 842.

Nonpublic entities that elect to apply the practical expedient may need to set up new processes to periodically update the common control arrangement to make sure they can continue to use the expedient. For example, if the written terms and conditions are for a short lease term (e.g., a one-month or a one-year lease), and those written terms and conditions expire, the entity will not be able to use the practical expedient and will need to evaluate the legally enforceable terms and conditions, like any other lease between unrelated parties or related parties not under common control.

Also, if the written terms and conditions allow the lessee to extend the one-month or the one-year lease at its option, or if the lease continues unless terminated by either party and the lessee would incur a significant penalty to terminate the lease (for example, because it would lose the benefit of significant leasehold improvements), the guidance in ASC 842 on determining the lease term applies, which may result in a lease term for accounting that is longer than the stated term.

The FASB decided not to prescribe the documentation requirements necessary to use the practical expedient.[7] Rather, entities can use reasonable judgment to determine how terms and conditions of an arrangement are conveyed in writing. Therefore, we believe that a written document does not need to meet the legal definition of a contract to qualify for the practical expedient. For example, an email documenting the written terms and conditions of the arrangement may suffice, even if it does not include other clauses that generally appear in a legal contract.

Accounting for Reasonable Leases

The Update states that:

- A lessee amortizes leasehold improvements associated with a common control lease over the useful life of those improvements to the common control group, regardless of the lease term, if the lessee controls the use of the underlying asset through a lease. If the lessor obtained the right to control the underlying asset’s use through a lease with another entity outside the common control group, then the amortization period cannot exceed the amortization period of the common control group determined in accordance with ASC 842-20-35-12.

- If the lessee loses control of the use of the leased asset to another entity in the common control group, the remaining balance of leasehold improvements is accounted for as a transfer between entities under common control through an adjustment to equity (or net assets for a not-for-profit entity).

While the FASB received concerns about the requirements in ASC 842 mostly from private company stakeholders, it concluded that these changes better reflect the economics of leasehold improvements in common control leases and therefore the changes apply to all entities.

In response to the changes discussed above, the FASB also clarified that leasehold improvements associated with common control leases are:

- Not considered lease payments

- Assessed for impairment by applying the guidance in ASC 360, Property, Plant and Equipment, for long-lived assets to be exchanged or distributed to owners in a spinoff, considering the improvements’ useful life to the common control group.[8]

After a lease’s commencement date, any change in the amortization period for leasehold improvements because of a change in a common control relationship is accounted for prospectively as a change in accounting estimate.

Insights

Unlike the practical expedient on evaluating terms and conditions of a lease, the guidance on amortization and transfers of leasehold improvements applies to both public and nonpublic entities. This means that:

- Public entities that have adopted ASC 842 may need to make changes to existing processes, systems, or controls to comply with this new guidance.

- Public and nonpublic entities need to identify changes to common control relationships after a lease’s commencement date on a timely basis, and account for the resulting change for the leasehold improvements prospectively. Entities should consider whether they need to specifically track information or other events in their lease system that are not otherwise monitored for lease accounting.

Disclosures

The Update requires lessees to provide the following disclosures when the useful life of leasehold improvements to the common control group exceeds the related lease term:

- The unamortized balance of the leasehold improvements at the balance sheet date

- The remaining useful life of the leasehold improvements to the common control group

- The remaining lease term

Additionally, entities must consider the disclosure requirements in ASC 850, Related Party Transactions, to provide users of financial statements with sufficient information to analyze an entity’s common control arrangements.

Effective Dates and Transition

The Update is effective for public and nonpublic entities in fiscal years, including interim periods within those fiscal years, starting after December 15, 2023. Early adoption is permitted for all entities in any annual or interim period as of the beginning of the related fiscal year.

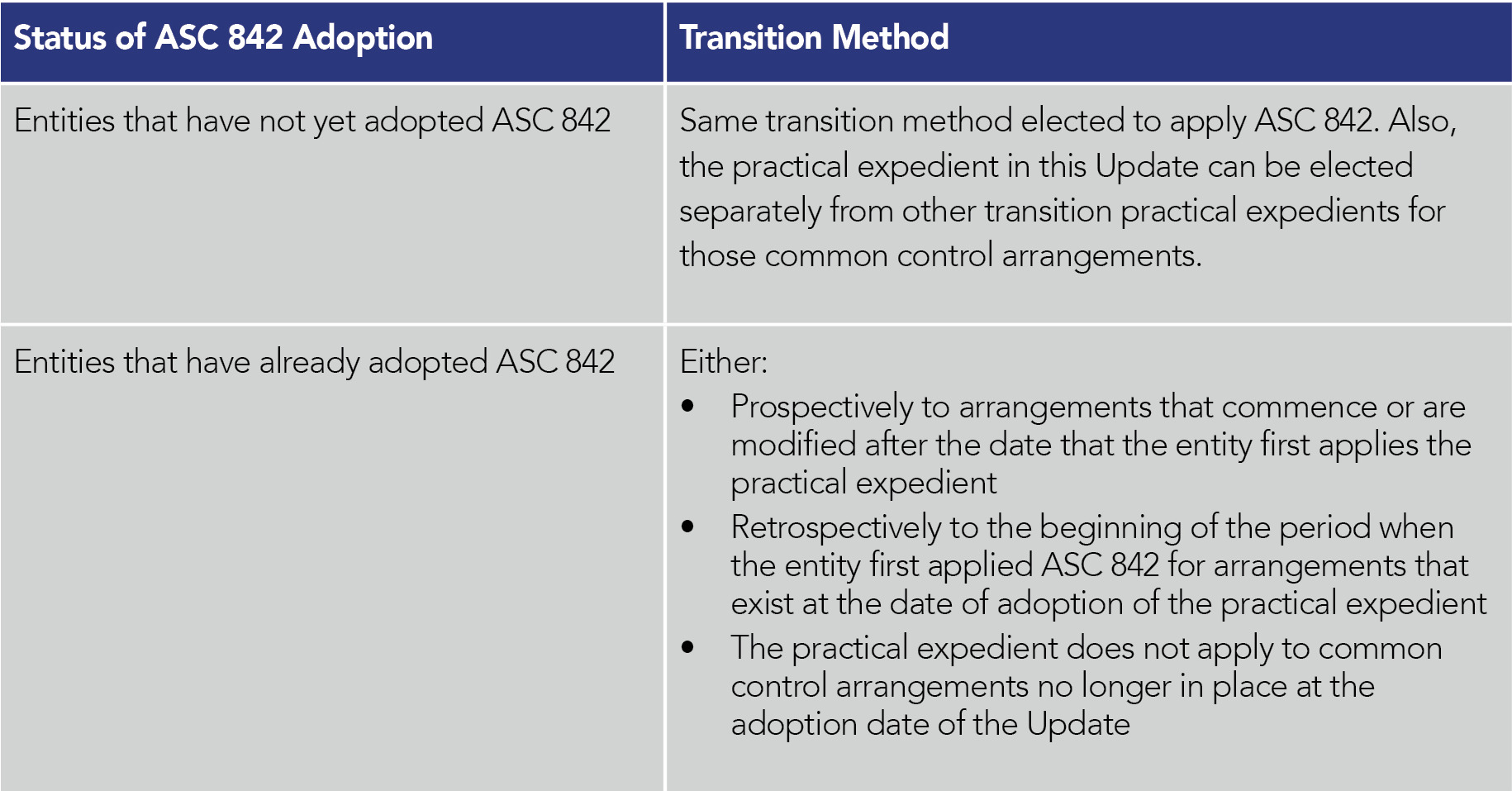

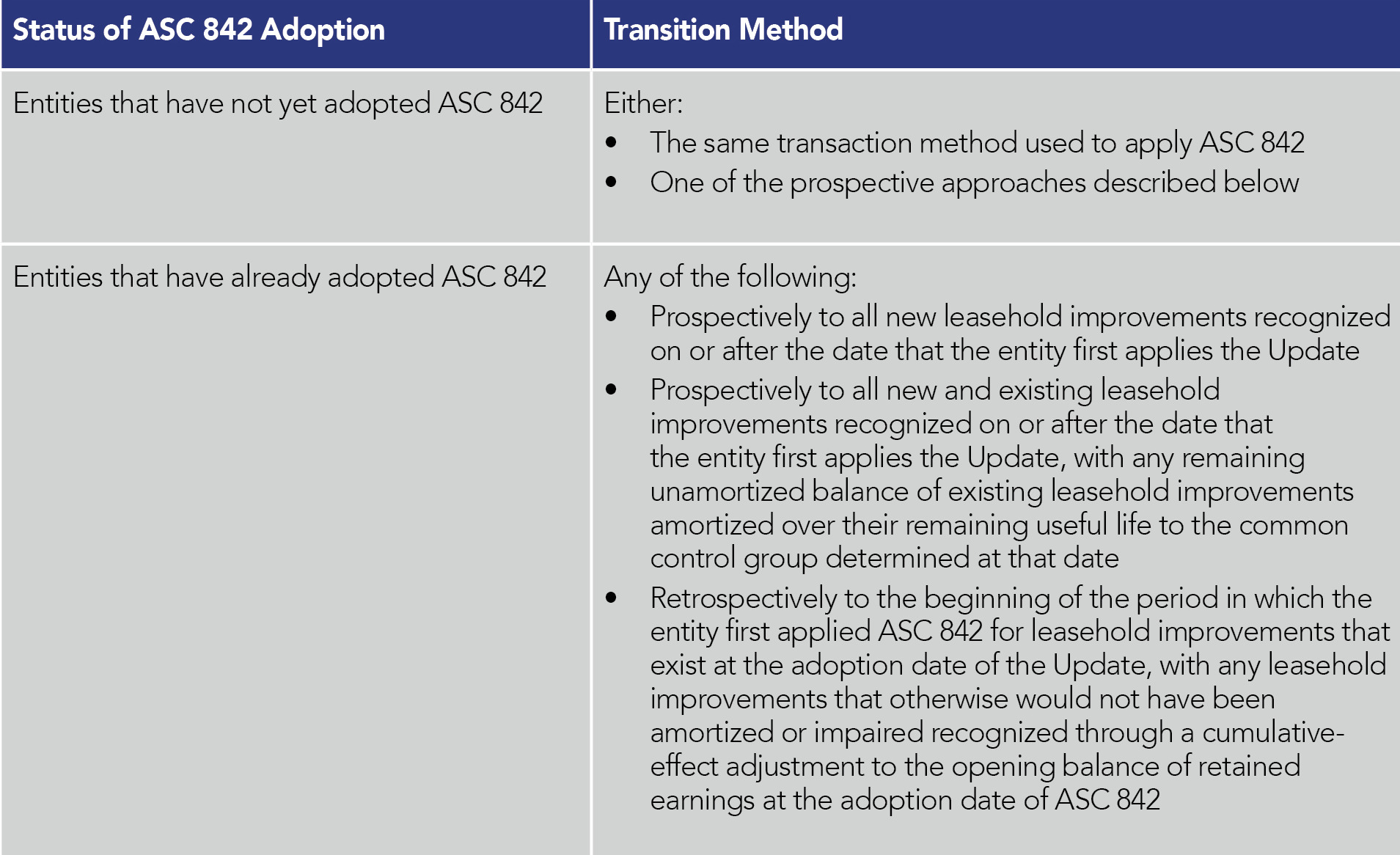

The Update will be applied using the following transition methods:

Terms and Conditions to Be Considered (Nonpublic Entities Only)

Accounting for Leasehold Improvements (All Entities)

[1] Includes entities that are not: public business entities (as defined in U.S. GAAP), not-for-profit entities that have issued or are conduit bond obligors for securities that are traded, listed, or quoted on an exchange or an over-the-counter market or employee benefit plans that file or furnish financial statements with or to the U.S. Securities and Exchange Commission. [2] Leases (ASC 842): Common Control Arrangements [3] Leasehold improvements generally constitute improvements made by a lessee to the underlying leased asset for which the lessee is determined to be the accounting owner and are recognized on a lessee’s balance sheet. [4] Basis for Conclusions (BC) 10 and BC11 of the Update. [5] BC40 of the Update. [6] BC22 of the Update. [7] ASC 360-10-40-4Written by Thomas Faineteau, Angela Newell and Bobbi Gwinn. Copyright © 2023 BDO USA, LLP. All rights reserved. www.bdo.com

Latest News

On June 9, the IRS released Announcement 2022-13, which modifies Notice 2022-3, by revising the optional standard mileage ...

At the tail end of 2021, the Internal Revenue Service (IRS) released new Schedules K-2 and K-3 effective ...

This information is current as of Sunday, November 21, 2021. On Friday, November 19, 2021, after the Congressional ...

HM&M Updates

DALLAS, Dec. 11, 2024 – Springline Advisory, a trailblazing financial and business advisory firm, is proud to announce its partnership ...

Last month, Senior Manager, Pearl Balsara was invited to speak at the 2023 FPA DFW Annual Conference in ...

We are pleased to announce the winners of the 2022 HM&M Excellence Awards. Ronna Beemer, Keith Phillips, and ...